Investing in Chromium Stocks: A Comprehensive Guide for 2024

Understanding the Chromium Market

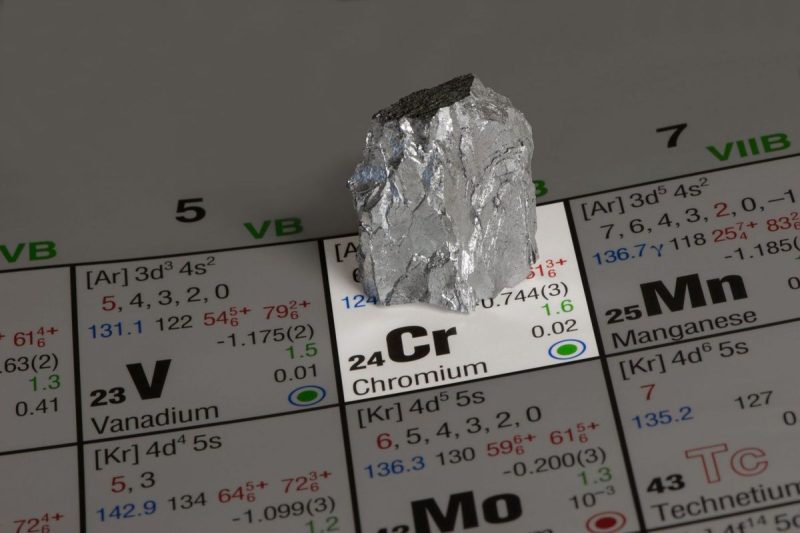

Chromium is a crucial element in various industries, including stainless steel production, aerospace, and automotive sectors. The demand for chromium continues to grow due to its corrosion-resistant properties, making it an essential material for a wide range of products. As an investor looking to capitalize on this market, it’s important to have a solid understanding of the key factors that can influence chromium prices and stock performance.

Factors Driving Chromium Prices

Several factors can impact the price of chromium, including global economic conditions, supply and demand dynamics, geopolitical events, and technological advancements. Monitoring these factors can provide valuable insights into the potential direction of chromium prices, helping investors make informed decisions about when to buy or sell chromium stocks.

Investment Strategies for Chromium Stocks

When investing in chromium stocks, it’s important to consider your investment goals, risk tolerance, and time horizon. Some investors may prefer a long-term buy-and-hold strategy, while others may opt for more active trading strategies to capitalize on short-term price movements.

Diversification is key when building a portfolio of chromium stocks to mitigate risk and maximize returns. Investing in a mix of companies across different sectors that use chromium in their products can help spread out risk and capture opportunities in various market segments.

Identifying Promising Chromium Stocks

Researching and selecting promising chromium stocks requires a thorough analysis of the company’s financials, competitive positioning, growth potential, and industry outlook. Look for companies with strong fundamentals, a proven track record of profitability, and a solid growth strategy.

Companies that are well-positioned to benefit from emerging trends in the chromium market, such as increasing demand for electric vehicles and renewable energy technologies, may offer attractive investment opportunities. Additionally, companies with a diversified customer base and a global presence are better equipped to navigate market volatility and economic uncertainties.

Monitoring and Managing Your Chromium Investments

Once you’ve built a portfolio of chromium stocks, it’s crucial to monitor your investments regularly and stay informed about market developments that could impact your holdings. Keep track of company earnings reports, industry news, and macroeconomic trends to assess the performance of your investments and adjust your strategy as needed.

Consider setting stop-loss orders to limit potential losses and protect your investment capital in case of unexpected market downturns. Regularly reviewing your portfolio allocation and rebalancing your holdings can help optimize your returns and manage risk effectively over time.

In conclusion, investing in chromium stocks can be a rewarding opportunity for investors who are willing to do their homework, diversify their holdings, and stay proactive in managing their investments. By understanding the key factors influencing chromium prices, identifying promising companies, and implementing sound investment strategies, investors can potentially capitalize on the growth prospects of this essential metal in the years to come.