Investing in Tin Stocks: A Comprehensive Guide Updated for 2024

Understanding the Tin Market

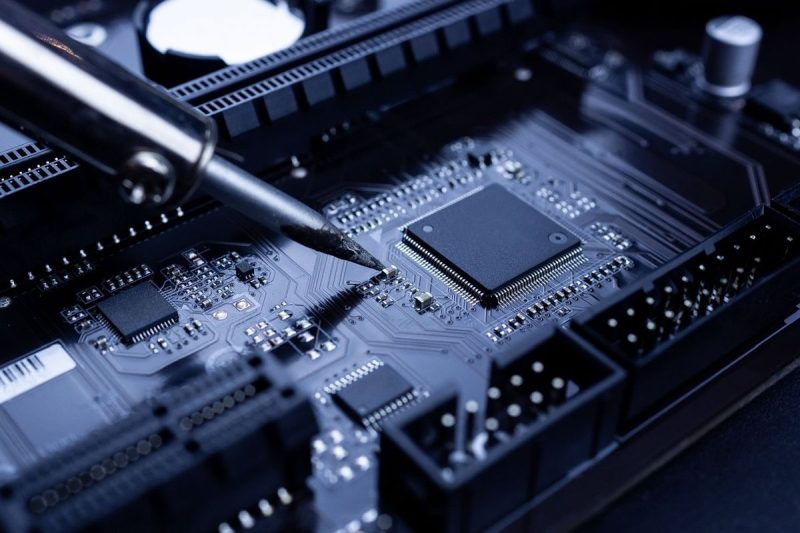

Tin, a versatile and valuable metal, has a range of industrial applications, making it a sought-after commodity by investors. With its diverse uses in electronics, batteries, and packaging, the tin market is an essential component of various industries worldwide. Analyzing the global demand for tin and its supply dynamics is crucial when considering investing in tin stocks.

Factors Influencing Tin Prices

Several factors impact the price of tin, including global economic conditions, geopolitical events, and supply chain disruptions. For instance, changes in government regulations, natural disasters, and mining strikes can affect tin production and pricing. Investors need to stay informed about these influent factors to make informed decisions about investing in tin stocks.

Choosing the Right Tin Stocks to Invest In

When selecting tin stocks for investment, investors should consider various criteria, such as the company’s financial performance, exploration projects, and growth potential. Conducting thorough research on tin mining companies, their track records, and operational efficiency is essential. Additionally, evaluating the company’s sustainability practices and adherence to environmental regulations can provide valuable insights for investors.

Diversification and Risk Management

Diversification is a key strategy to mitigate risks when investing in tin stocks. By diversifying their portfolio across multiple tin mining companies, investors can spread their risk exposure and enhance their chances of generating returns. It is advisable to assess the overall risk tolerance and investment goals before allocating funds to tin stocks.

Market Trends and Forecast

Staying updated on market trends and forecasts is essential for successful investing in tin stocks. Analyzing market reports, industry publications, and expert opinions can help investors make informed decisions. Considering long-term projections for tin demand and supply can guide investors in creating a sustainable investment strategy tailored to their financial objectives.

Monitoring and Rebalancing

Regularly monitoring the performance of tin stocks in a portfolio is crucial for investors. Tracking key performance indicators, market news, and financial reports can help investors assess the health of their investments. Rebalancing the portfolio based on changing market conditions and investment goals is essential to optimizing returns and managing risks effectively.

Conclusion

Investing in tin stocks can offer lucrative opportunities for investors seeking exposure to the commodities market. By understanding the dynamics of the tin market, conducting thorough research, and staying informed about market trends, investors can make strategic decisions to build a diversified and resilient portfolio. With careful risk management and a long-term investment perspective, investing in tin stocks can be a rewarding venture for investors looking to capitalize on the potential growth of the tin industry.