The article discusses the potential for a rally in the value of the US dollar (USD) and the factors contributing to this possible trend. The USD has endured a series of challenges in recent times that have weakened its position in the global currency market. However, there are indications that the USD may be set for a rebound, resulting in a rally that could potentially boost its value against other major currencies.

One key factor driving the possible USD rally is the broader macroeconomic landscape. The Federal Reserve’s commitment to maintaining a hawkish stance on monetary policy, including interest rate hikes and potential tapering of asset purchases, has been cited as a significant driver of USD strength. As global economies recover from the impact of the COVID-19 pandemic, the US stands out as a leader in terms of economic growth and resilience. This relative strength could attract foreign investment flows into USD-denominated assets, further supporting the currency’s value.

In addition, geopolitical developments play a crucial role in shaping currency trends. The ongoing tensions between the US and China, as well as disruptions in global supply chains, have highlighted the USD’s status as a safe haven currency. In times of uncertainty and market volatility, investors often flock to the USD as a stable and reliable asset, which could further contribute to a potential rally in its value.

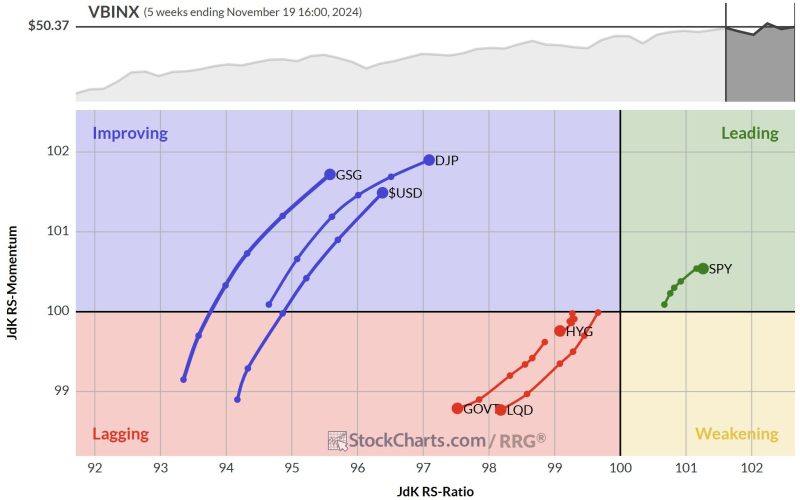

Moreover, technical analysis of the USD suggests that it may be poised for a reversal and subsequent uptrend. Chart patterns and key support levels indicate that the USD could be nearing a turning point, with the potential for a breakout to the upside. If confirmed, this technical setup could fuel momentum in the USD rally and attract more traders and investors seeking to capitalize on the currency’s strengthening trend.

Despite these bullish indicators, it is essential to acknowledge the risks and uncertainties that could impede the USD rally. Factors such as inflationary pressures, changes in market sentiment, and unexpected geopolitical events could derail the currency’s upward trajectory. Therefore, investors should exercise caution and closely monitor developments in the global economy and financial markets to make informed decisions regarding their USD exposure.

In conclusion, the USD may be on the brink of a significant rally, driven by a combination of macroeconomic factors, geopolitical tensions, and technical signals. While the outlook for the currency appears promising, market participants should remain vigilant and adaptable to navigate potential risks and capitalize on opportunities presented by the evolving currency market dynamics.