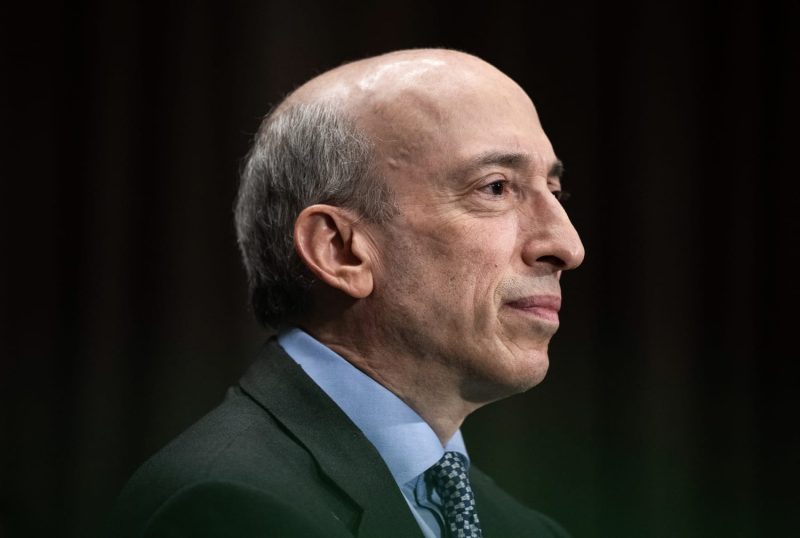

The recent announcement of SEC Chair Gary Gensler’s impending departure on January 20 has sent shockwaves through the financial industry. Gensler, known for his proactive approach to regulating the financial markets, leaves behind a legacy of impactful regulatory changes that have reshaped the landscape of Wall Street during his tenure. As the nation eagerly anticipates his replacement under the Trump administration, there is a palpable sense of uncertainty and speculation surrounding the future direction of the SEC.

Gensler, a former Goldman Sachs executive turned regulator, took the helm of the SEC in April 2021 with a clear mandate to enhance transparency, accountability, and oversight in the financial sector. Throughout his tenure, he championed numerous regulatory reforms aimed at protecting investors, combating market manipulation, and promoting fair and efficient capital markets. Gensler’s tenure was marked by a renewed focus on digital assets, cryptocurrencies, and the decentralized finance (DeFi) space, as he sought to bring greater clarity and regulatory oversight to these rapidly evolving sectors.

Despite facing fierce opposition from industry lobbyists and some lawmakers, Gensler remained steadfast in his commitment to enhancing investor protection and market integrity. His tenure saw a record number of enforcement actions against companies accused of securities violations, insider trading, and other forms of misconduct. Gensler also spearheaded efforts to address environmental, social, and governance (ESG) issues, pushing for greater corporate disclosure requirements related to climate change, diversity, and sustainability.

As Gensler prepares to step down, the financial industry is left grappling with a myriad of questions and uncertainties. Who will be appointed as his successor? Will the new SEC chair continue Gensler’s regulatory agenda, or will there be a shift in priorities under the Trump administration? How will ongoing regulatory initiatives, such as the review of market structure and enforcement priorities, be affected by the leadership change?

The upcoming transition at the SEC presents both challenges and opportunities for the financial industry. While some stakeholders may welcome a more industry-friendly approach under the Trump administration, others may express concerns about potential rollbacks of key regulatory reforms implemented during Gensler’s tenure. The incoming SEC chair will face significant pressure to strike a delicate balance between facilitating capital formation and protecting investors, all while navigating a rapidly evolving financial landscape characterized by technological innovation, market volatility, and geopolitical uncertainties.

In conclusion, as SEC Chair Gary Gensler prepares to depart on January 20, his legacy as a proactive and vigilant regulator will undoubtedly leave a lasting impact on the financial industry. The upcoming transition at the SEC under the Trump administration signals a new chapter in the regulation of capital markets, with profound implications for investors, companies, and regulators alike. The nation awaits the appointment of Gensler’s successor with great anticipation, as the future direction of the SEC will shape the course of financial regulation in the years to come.