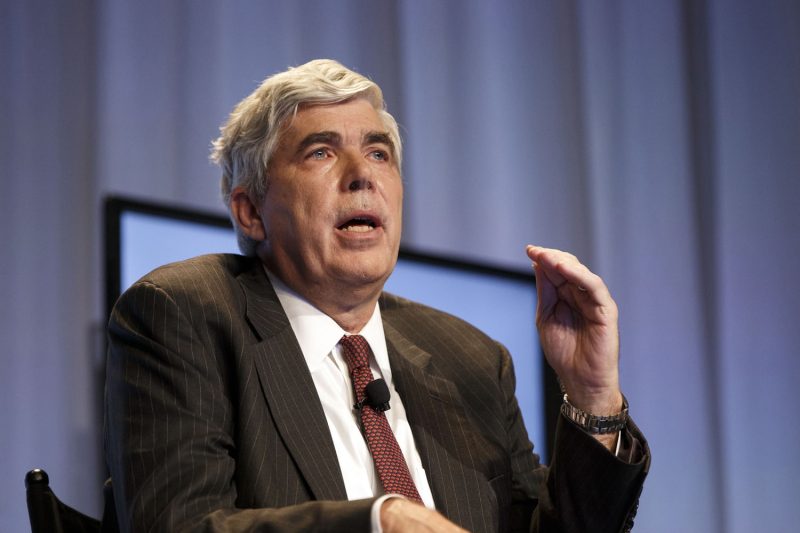

Kenneth Leech, a former executive at WAMCO, was recently charged with fraud by the U.S. authorities. This development has sent shockwaves through the financial industry and raised concerns about corporate governance practices. Let’s take a closer look at the details of the case and its potential implications.

The Charges Against Kenneth Leech

According to the charges filed by the U.S. government, Kenneth Leech engaged in fraudulent activities that resulted in significant financial losses for investors and stakeholders. The allegations claim that Leech manipulated financial statements to artificially inflate the company’s financial performance, misleading investors and regulators.

Furthermore, it is alleged that Leech used his position of power within WAMCO to enrich himself through illegal means, including insider trading and embezzlement. These actions not only violated ethical standards but also undermined the trust and integrity of the financial markets.

Implications for Corporate Governance

The case of Kenneth Leech sheds light on the importance of robust corporate governance practices within organizations. Corporate governance encompasses the mechanisms, processes, and relations by which companies are controlled and directed. It plays a crucial role in safeguarding the interests of various stakeholders, including shareholders, employees, customers, and the broader society.

The allegations against Leech highlight the need for increased transparency, accountability, and oversight in corporate decision-making. Companies must establish strong internal controls, ethical guidelines, and compliance mechanisms to prevent fraudulent activities and misconduct within their ranks.

Moreover, the case underscores the significance of regulatory enforcement and legal consequences for individuals who engage in fraudulent behavior. Authorities must remain vigilant in detecting and prosecuting financial crimes to maintain the integrity of the financial system and protect investors from harm.

Lessons Learned

The case of Kenneth Leech serves as a cautionary tale for executives and professionals in the financial industry. It underscores the severe consequences of unethical conduct, fraudulent practices, and violations of trust. Individuals in positions of power must uphold the highest standards of integrity, honesty, and accountability to preserve the reputation and credibility of their organizations.

In conclusion, the charges against Kenneth Leech highlight the importance of ethical leadership, corporate governance, and regulatory compliance in today’s business environment. Companies and individuals must prioritize integrity and transparency to build trust, foster sustainable growth, and contribute to a healthier financial ecosystem.